Ecommerce credit card processing

Our eCommerce expertise is unrivaled, and we have the clients to prove it. Get chargeback mitigation, improve decline rates, recurring billing, and more with Easy Pay Direct.

Our tailored solutions work for almost any product, and we will get you approved. Worry less about e-commerce credit card processing, and focus more on scaling your business.

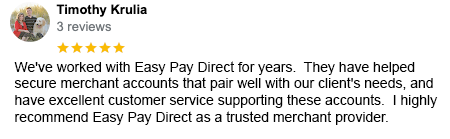

RAVING FANS

Take Advantage Of Our E-commerce Merchant Services!

Last year, Payment Aggregators, including Stripe, closed down millions of e-commerce merchant accounts, and the reason will shock you…

Simply put… It’s how their business model works!

They have one merchant account, which they let millions of merchants use. In doing so, they balance the risk between solid ethical business owners with entrepreneurs who would commit fraud, launder money, sell a poor-quality product, or close their doors before a consumer asks for a refund.

This allows companies like Stripe to set you up quickly, but it also allows them to shut you down even quicker.

The problem is that they don’t know anything about you when they set you up. They don’t know who you are, what you sell, or how you sell it.

If they set you up and anything unusual happens, such as a spike in chargebacks, the likelihood of them closing your account is HIGH.

Even worse, if one of your competitors does anything to trigger a flag in their system, they look at the entire industry. And through no fault of your own, a competitor’s misstep could mean a closed account for you.

What Distinguishes Easy Pay Direct And Our E-commerce Merchant Services?

How do we maintain stable merchant accounts for our clients?

The KEY component is thorough underwriting.

Our specialists underwrite your account so that we understand your business and marketing model. This allows us to match you with a back-end bank that works with your vertical.

Which greatly lowers the chance of you ever having an issue.

In addition, recurring billing, mobile payments, hosted checkout, access to our fraud protection services, a single point of contact, and integration with more than 250 shopping carts are all included when you sign up with us.

For the duration of your account, we’ll also collaborate with you to optimize your payments.

Among many other things, lowering your decline rates to boost revenue, keeping an eye on and mitigating your chargeback ratios.

We Specialize In E-Commerce Merchnat Accounts.

Ask Our Clients, Partners, Or Anyone Selling Anything Online…

Grant Cardone

Tony Robbins

Frank Kern

Dean Graziosi

Amy Porterfield

Perry Belcher

Roland Frasier

Ryan Deiss

Wes Watson

Safe Life Defense

iGenius

Closers.io

What If Your Merchant Account Was Closed Today?

How long could you stay open if your merchant account was closed today, and you were unable to accept credit cards?

Everyday basic payment facilitators and companies like Stripe, PayPal, Square, Shopify, etc. Shut down thousands of accounts.

It’s not a matter of IF you’ll get shut down, but WHEN…

If your provider held your money for 90 days, would you survive?

If they placed a 10% hold on your account, could you make payroll?

It’s time to upgrade to Easy Pay Direct and trust our credit card processing services for e-commerce!

What Other Features Does Easy Pay Direct Offer?

Transaction Routing – We’ll automatically route your transactions across multiple accounts. That way if anything ever happens to one, your others are still up and running.

White Glove Service – You’ll have a dedicated point of contact that you can reach any time you need them.

Decline Recovery – We’ll help you improve your approval ratios and reduce decline rates. That way, you put more cash back in your pocket and process more payments.

Chargeback Mitigation – Stop chargebacks before they begin with. Our chargeback alert system. Greatly lower account issues and improve customer satisfaction.

Hosted Checkout – Quickly create checkout links and landing pages with a few clicks. Email them, DM them, or text them to your clients for payments on the fly.

Recurring Billing – Built-in recurring billing for subscription purchases with multiple payment options available

Mobile Payments – Process payments on the go with our easy to use mobile payment solution

250+ Integrations – Integration to nearly every shopping cart, plus we integrate to most apps and software. If you need something specific, our in-house development team will make it happen.

Banking For Nearly Every Vertical – We offer accounts for almost every vertical, including high risk merchants, travel merchant accounts, SaaS merchant accounts and much more. Get approved today.

Unlimited High Ticket – Worry free processing of high ticket transactions on high volume merchant account.

Ecommerce Credit Card Processing Info & FAQs

Ecommerce FAQ

How does ecommerce credit card processing work?

Ecommerce credit card processing works by allowing customers to make purchases on an ecommerce website using their credit or debit card. When a customer makes a purchase, their credit card information is transmitted to the merchant’s ecommerce platform, which then sends the information to the merchant’s payment gateway. The payment gateway then forwards the information to the customer’s credit card issuer for authorization. Once the transaction is authorized, the funds are transferred from the customer’s credit card account to the merchant’s bank account.

Are there any additional fees associated with e-commerce credit card processing?

There may be additional fees associated with ecommerce credit card processing, such as a percentage of each transaction, a flat fee per transaction, or a monthly account fee. It’s important to carefully review the terms and fees of any eCommerce merchant account before signing up to ensure that you fully understand the costs involved.

What are the main benefits of credit card processing for ecommerce?

The main benefits of ecommerce credit card processing include the ability to accept payments from customers 24/7, the ability to reach a wider customer base, and increased sales and revenue.

Is it difficult to set up ecommerce credit card processing for my website?

Setting up ecommerce credit card processing for a website can be more complex than setting it up for a brick-and-mortar business. But, there are many ecommerce platform providers (such as Shopify, Magento, and BigCommerce) that offer built-in solutions for accepting credit card payments on a website, so you can also integrate a third-party payment gateway like Stripe, PayPal and authorize.net into your website.

What types of security measures are used in ecom credit card processing?

Credit card processing for e-commerce typically uses several types of security measures to protect sensitive customer information, such as SSL encryption to protect data transmitted over the internet, PCI compliance to secure data stored on the merchant’s server, and fraud detection and prevention tools to reduce the risk of fraudulent transactions.

Ecommerce Credit Card Processing General Information

ECOMMERCE CREDIT CARD & PAYMENT PROCESSING

Ecommerce credit card processing is the soul of an online business.

If your business accepts online payments from credit and debit cards, you are an eCommerce site. Without the ability to accept credit and debit cards, an online business has little chance to succeed.

WHAT IS AN ECOMMERCE TRANSACTION ON A CREDIT CARD?

An eCommerce transaction is virtually any online transaction made with a credit card.

These are called Card Not Present, or CNP transactions, since the card is not physically present.

WHAT IS AN ECOM TRANSACTION IN CREDIT CARDS?

An ECOM transaction is the same as an eCommerce transaction.

ECOM refers to Electronic Commerce Online Marketing or eCommerce Online Marketing. It applies to credit and debit cards.

WHAT IS PCI COMPLIANCE, AND HOW DOES IT APPLY TO AN ECOMMERCE MERCHANT ACCOUNT?

The Payment Card Industry Data Security Standard applies to all payment processing entities and all businesses and services accepting credit cards.

The major credit card companies created PCI to mitigate fraud.

In e-commerce, credit card payments must stay compliant. That means merchants must take specific measures to keep all cardholder data safe by concentrating on network security.

HOW ARE ECOMMERCE PAYMENTS PROCESSED?

Once the merchant has established a payment gateway or online version of a Point of Sale (POS) terminal, eCommerce payment processing can start. The payment gateway connects the online retailer to the payment processor and sends the transaction request.

The payment processor processes and executes the payment. Funds leave the customer’s account and get deposited into the merchant account.

An eCommerce merchant account is not absolutely necessary. However, eCommerce businesses benefit from the enhanced security of merchant account providers.

If your business has a brick-and-mortar component, your eCommerce merchant account provider can also provide you with POS capability.

WHAT KINDS OF PAYMENTS ARE ACCEPTED?

Your merchant account provider should give your business access to eCommerce payment processing that includes more than just payment processing.

You should be able to accept echecks or ACH transactions, as well as Apple Pay and other common payment options.

Keep in mind that many common payment processors, such as PayPal, do not work with high-risk businesses. Your processing service should accept international payments.

Even if the bulk of your business is domestic, not having the ability to accept international payments can hamper your sales.

ECOMMERCE CREDIT CARD PROCESSING FEES

Credit card companies charge payment processing fees for each ecommerce transaction.

Banks issuing the cards receive these fees. They average 1.81% for a credit card and 0.3% for a debit card.

Fees also vary by card type. A high-end reward card will charge a higher fee than a standard, no-rewards card.

Expect to pay one-time fees to set up your eCommerce merchant account. Besides the setup fees, these involve address verification and compliance fees.

TYPES OF INCIDENTAL FEES

Incidental fees may include:

-

- Annual fees

- IRS report fee

- Monthly minimum fee

- Statement fee

Read the contract carefully. You may prove subject to an early termination fee.

Some fees are fixed and non-negotiable. These include interchange fees.

Others will vary depending on the volume of business and the type of payment processing. For instance, an in-store, POS transaction carries the least amount of risk. It also carries the lowest fee.

Merchant account providers categorize ecommerce transactions as risky, and fees reflect that.

WHAT SHOULD YOU LOOK FOR IN ECOMMERCE CREDIT CARD PROCESSING?

Choosing the right merchant account provider and credit card processing service is among the most crucial decisions you’ll make for your business.

When searching for payment processing services, make sure the payment gateway provides:

-

- Transparent fee structure – Fees will vary according to the payment processing company. Just make sure you understand the pricing structure. Some merchant account providers make the fee structure so complicated that even experienced business owners have difficulty understanding the basic pricing model.

- Low risk vs. high risk – A high-risk merchant will pay more for an eCommerce merchant account than a low-risk merchant. Factors determining low vs. high risk include the number of chargebacks and the opportunity for fraud.

- Strong customer support – If there’s an issue, you want a credit card processing company that responds quickly and resolves the problem.

- Ease of use – You want to run your online credit card processing transactions as simply as possible. A simple, intuitive commerce credit card processor makes life easier all around.

Shop around to find the best merchant account provider and credit card processing company for your needs.

Compare not only commerce credit card processing prices and fees, but the type of merchant services provided.

HOW EASY PAY DIRECT CAN HELP

Through our Easy Pay Direct payment gateway, online businesses can accept credit and debit cards.

Along with eCommerce credit card processing, we allow merchant accounts to offer other payment options, including echecks and online payments.

Our product is compatible with most online shopping carts and we work with dozens of banks worldwide.

Our name says it all.

There is no easier way for online high-risk merchants to thrive in the eCommerce universe than by using our simple, intuitive platform. We go above and beyond the already stringent compliance demands, so your information is secure.

Over 60,000 businesses trust us for their ecommerce credit card processing.

For more information, please contact us at 800.805.4949.

Merchant Account FAQ

What industries does Easy Pay Direct work with?

Easy Pay Direct specializes in high risk payment processing, but we also work with mid risk and low risk companies, offering affordable credit card processing.

Here is a short list of some business verticals we service:

- Antiques & Collectibles

- Apparel & Clothing

- Bad Credit

- Bus Lines

- Cannabis Support Businesses

- Caterers

- CBD Oil & CBD Products

- Continuity Products and Subscription Boxes

- Credit Repair

- Credit Monitoring

- Debt Collection

- Digital Streaming

- Document Preparation

- Fantasy Sports

- Firearms & Ammunition

- Furniture & Home Furnishings

- Health & Beauty

- Hotels & Lodging

- Insurance / Warranty

- Legal Services

- Magazine Subscriptions

- Medical Billing & Coding

- Medical Supplies

- Membership & Recurring Billing

- MLM Companies

- Transportation & Moving

- Non-Profit

- Nutraceuticals

- Pawnbrokers & Pawn Shops

- Pet Products

- Precious Metals

- Property Management

- SaaS Companies

- Seminars & Coaching

- SEO / SEM / Ad Agency

- Smoking Accessories

- Sports Betting

- Survivalist & Tactical Gear

- Telemedicine

- Tobacco & Cigar

- Travel & Timeshare

- Vape / e-Cig / eJuice

- Veterinarians

- Web Design & Development

Why is my business considered high risk?

“High Risk” is a banking industry term. It’s important to note that there are many business models that are seemingly low risk, but fall into the high risk category.

There is nothing wrong with being considered high risk and there are many factors that contribute to risk.

When a consumer buys an item with a credit card, they are given 6 months from the date of receiving the item to dispute the charge.

If your business is no longer operating, who do you think has to refund that money? The processor. This is where risk is created.

Certain businesses, marketing models, and industries have a higher rate of chargebacks, where they get labeled as high risk.

Even if your business is perfect, has never had a chargeback, and operates 100% “by the books”, you could be labeled high risk if you’re business or industry falls into a high risk category.

There are 3 main reasons a business can be considered high risk.

- The business has a greater chance of chargebacks occurring

- The business model may be new or legally regulated

- The business accepts a high number of card not present transactions (over the phone, email, eCommerce)

Check our high risk merchant services!

Do you provide merchant account services outside of the USA?

At this time, Easy Pay Direct offers merchant account services for the USA, UK and Canada. You can also contact us, if you need EU merchant account services. We are always working to expand our areas of processing and hope to serve a greater area in the near future.

Can my startup or new business be approved?

We have worked with many new brands and start-ups to get them approved and running. However, banks like to see a long history of transactions and an established history with a merchant before approving them.

But, that does not mean we can’t get you approved. Reach out to us today and we will walk you through your options.

How long does it take to get approved for a merchant account?

Once all of the necessary documents have been received, it typically takes 1-4 days to get approved.

Occasionally accounts can be approved in less than 24 hours, our team will work as quickly as possible to get your account up and running.

Get started now!

EASY PAY DIRECT STATS

30000+

BUSINESS

$12B+

PROCESSSED

20+

YEARS OF EXPERIENCE

Just a few success stories…

I WANT TO ACCEPT PAYMENTS NOW