Stripe and other aggregators are getting tighter and tighter with restrictions. It seems everything has a “high risk” label recently, and merchant accounts are getting shut down daily.

Do you know if your business is considered high risk ?

We just got a call from one of our partners in the telemedicine space letting us know that Stripe is actively shutting down telehealth/telemedicine accounts and has added more business types to their restricted merchants list.

We’ve also noticed that Stripe has updated their terms and conditions for a litany of different merchant types.

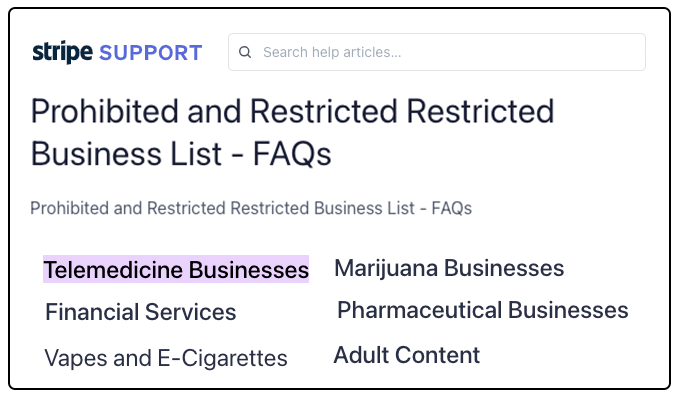

Here’s a quick overview of some of Stripes restricted business types. If you are in any of these and are currently processing with them, please get off ASAP and switch to a Full Service Merchant Account Provider.

From Stripes Website:

Please note that these are not all of their restricted business types. Make sure to check the entire list to ensure you don’t have account problems. Below are a few more common businesses that Stripe either won’t approve, or will shut down quickly.

Stripe, Square, Shopify etc… are payment aggregators. So they set up accounts quickly but know nothing about your business when they do.

So if you are in an industry they don’t like, or if you do something they don’t like… They will shut you down without notice.

You may be processing for 6 months and have a functional business, then BOOM, your account shut down, and you can no longer process payments or pay your bills.

More Restricted Stripe Business Types:

• Content Creation

• Debt Relief

• Gambling

• Identity Services

• Bail Bonds & Law Firms

• Lending & Credit

• Nutraceuticals & Supplements

• CBD & Cannabis

• Travel

• Informational Products & Courses

• Weapons & Firearms

Full service merchant account providers such as Easy Pay Direct:

For any of the above business types, you will need a full-service merchant account provider that does THOROUGH underwriting and knows your industry well.

We might be a little biased… but Easy Pay Direct is your go-to for any of these business verticals and many others.

There is a reason we are one of the top “high risk” credit card processors in the USA.

You’ve got problems? We will get you approved.

Don’t wait until your current payment processor decides to shut you down…

Give us a call here 800-805-4949

Or fill out the form at the bottom of the page to get started.

What is a payment aggregator? FAQ

What is a Payment Aggregator?

A payment aggregator is a service provider that allows merchants to accept payments from customers without setting up a direct merchant account with a bank or card network. Companies like Stripe act as intermediaries, aggregating multiple merchants’ transactions and facilitating the payment process.

How Does a Payment Aggregator Work?

Payment aggregators sign up merchants under their master merchant account. When a customer makes a payment, the aggregator processes the transaction on behalf of the merchant through its own system. The funds are initially received by the aggregator and then transferred to the merchant’s account, minus any fees charged by the aggregator.

Are There Any Drawbacks to Using a Payment Aggregator?

- Higher Transaction Fees: For businesses with a high volume of transactions, the fees charged by payment aggregators might be higher compared to direct merchant accounts.

- Account Stability Issues: Payment aggregators have the authority to freeze accounts or hold funds if they detect suspicious activity, which can impact business operations.

- Limited Negotiability: The terms, fees, and features are often set by the aggregator and may offer less flexibility compared to a direct merchant account.